New Delhi/Mumbai: Government's sale of a 5 per cent stake in top power producer NTPC Ltd received bids for 80 per cent more shares than were on offer for institutional investors on Tuesday, setting the government on course to raise about Rs. 5,000 crore.

Indian insurers alone bid for 30 per cent more stock than was on sale in the biggest share offering in the Indian market this year, the government said, without giving further details.

Assets sales are a major plank of the government's efforts to contain its budget deficit.

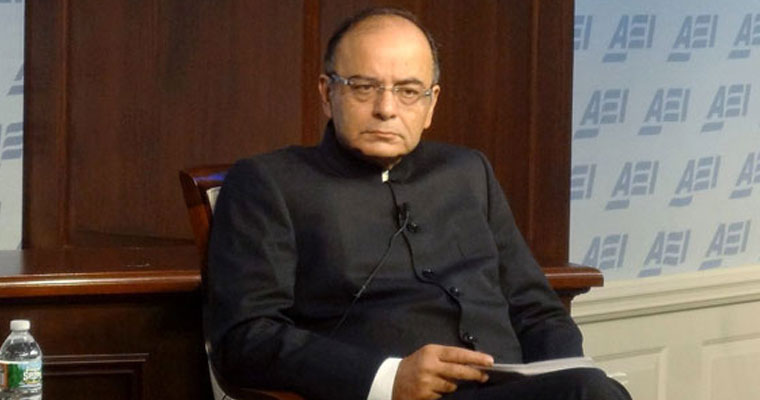

A slowdown in nominal economic growth has made it tougher for Finance Minister Arun Jaitley, who is due on February 29 to present his budget for the next fiscal year beginning April, to stick to a fiscal deficit target of 3.5 per cent of GDP.

For the current financial year, the government has budgeted for a fiscal deficit of 3.9 per cent of GDP, which economists say it will achieve despite missing asset sales targets for the sixth straight year.

Before the NTPC stake sale, the biggest divestment by the state in about six months, the government had managed to raise less than a fifth of its revenue target of around Rs. 68,000 crore from stake sales.

Institutional investors, both foreign and local, had shown little interest in previous asset sales this fiscal year due to concerns about state companies' growth prospects.

Life Insurance Corp, India's biggest portfolio investor, bought 86 percent of a Rs. 9,600 crore share sale in refiner and fuel retailer Indian Oil Corp in August.

Foreign investors accounted for about 23 per cent of the bids in the NTPC offering, which the government's divestment secretary Neeraj Gupta called "a good response". It was not immediately known how much LIC bid for in the NTPC sale.

Retail investors, for whom a fifth of the NTPC issue is reserved, can place bids on Wednesday, after which the final price and total proceeds will be ascertained. Unsubscribed shares from the retail portion will be allocated to the funds.

Write a comment

...

.jpg)